With great pleasure, we will explore the intriguing topic related to 2025 IRS Tax Tables: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

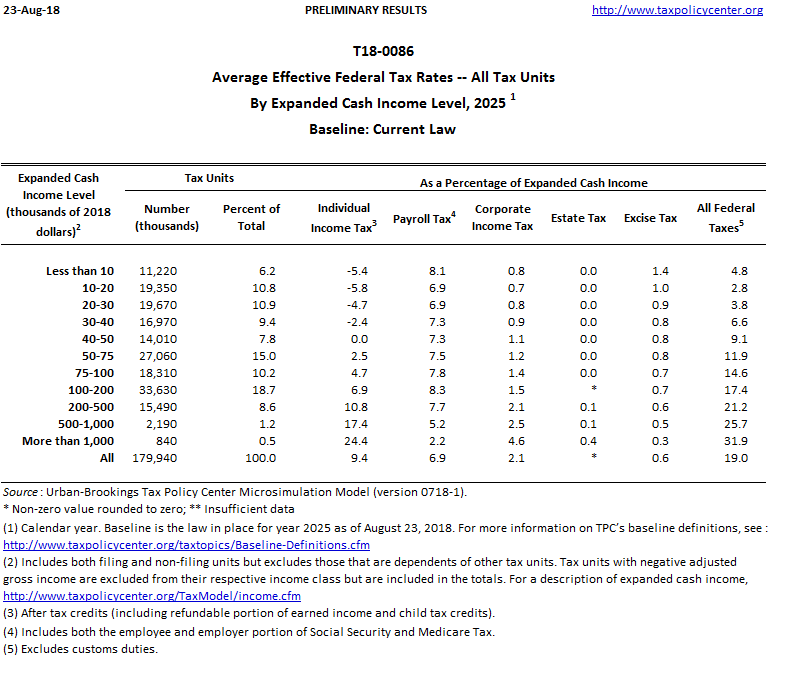

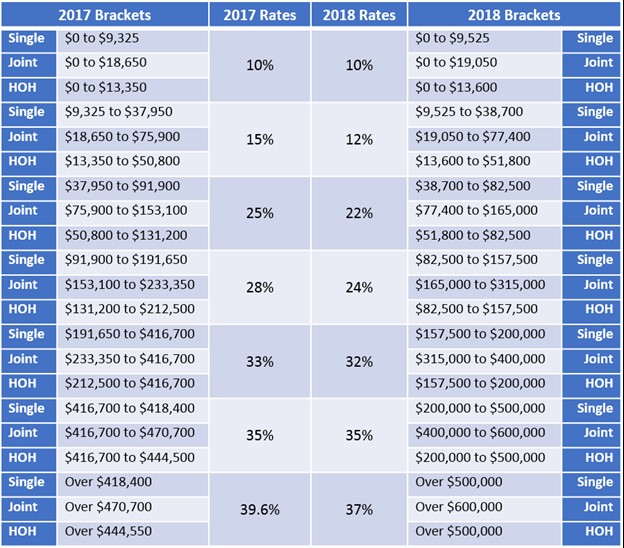

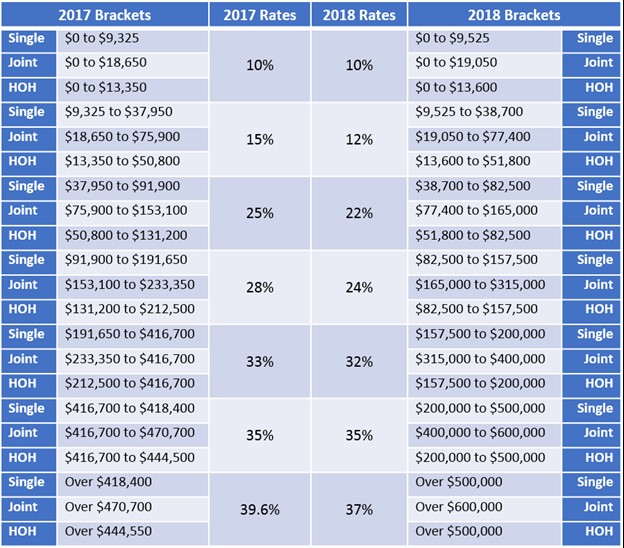

The Internal Revenue Service (IRS) recently released the 2025 tax tables, which will be used to calculate federal income taxes for the 2025 tax year. The tables have been updated to reflect the changes made by the Tax Cuts and Jobs Act (TCJA) of 2017, which significantly revised the federal tax code.

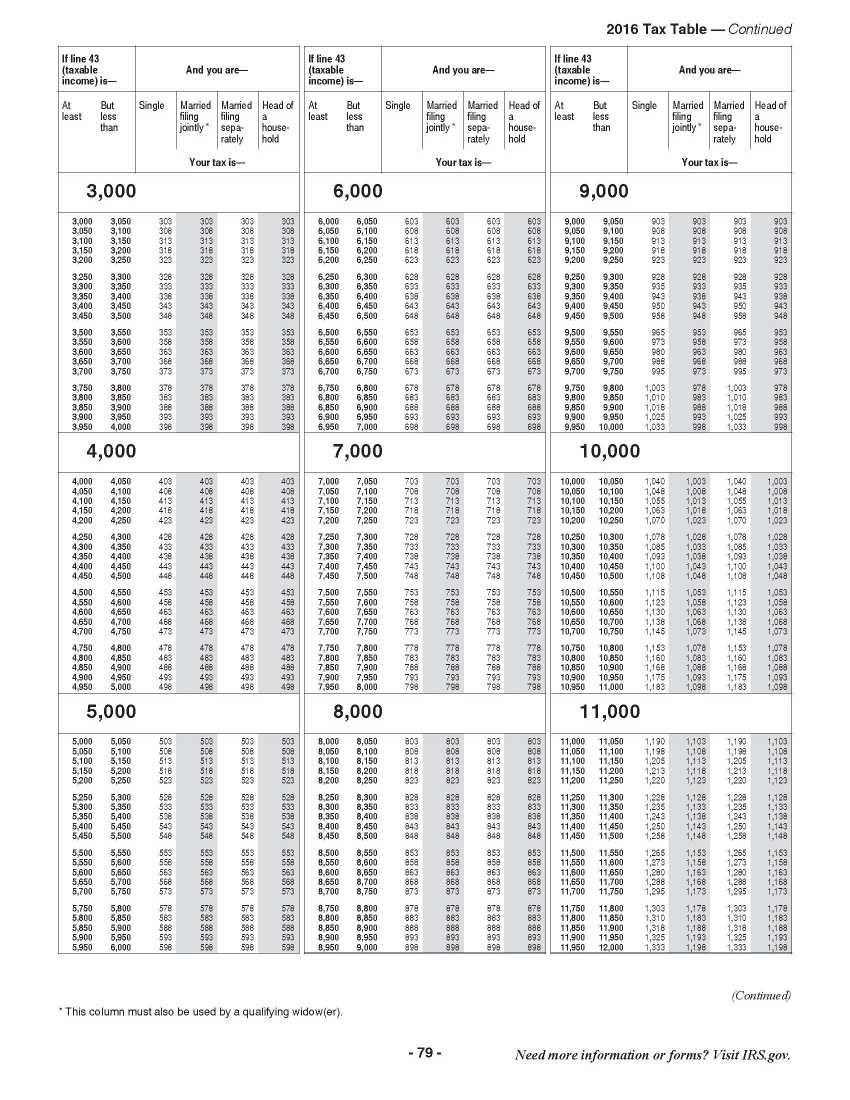

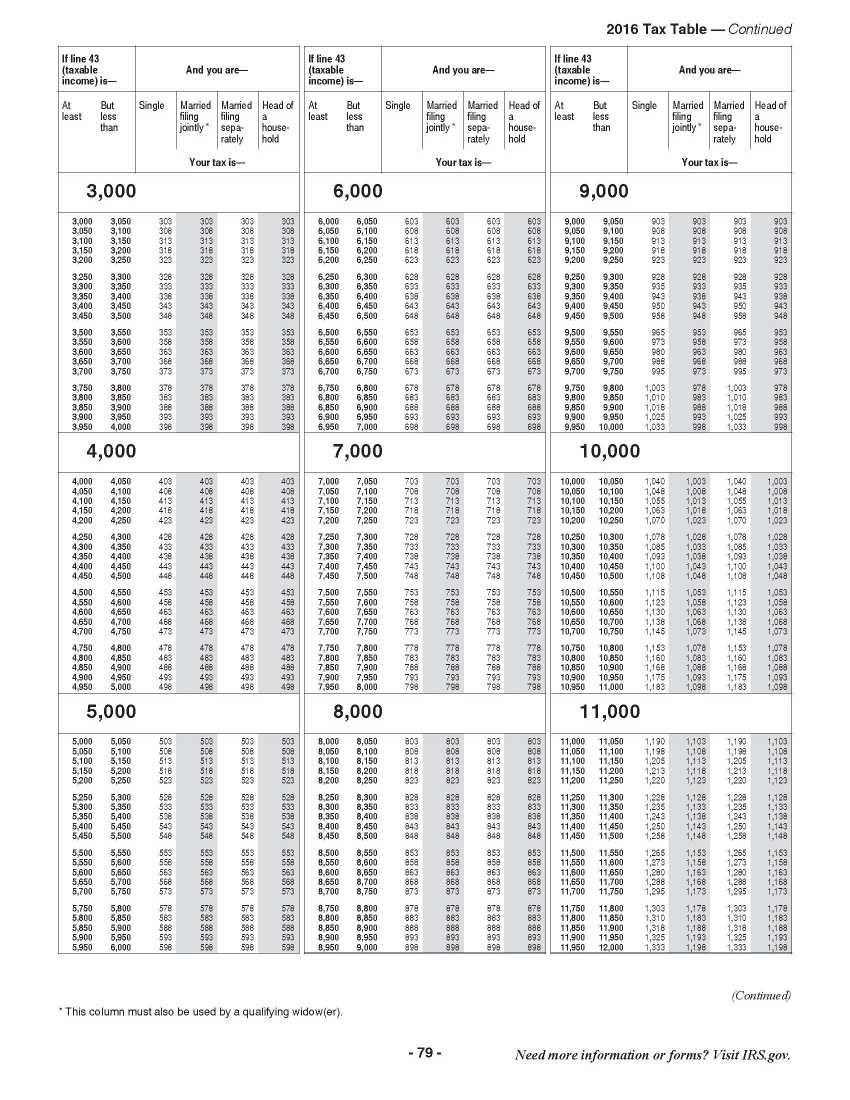

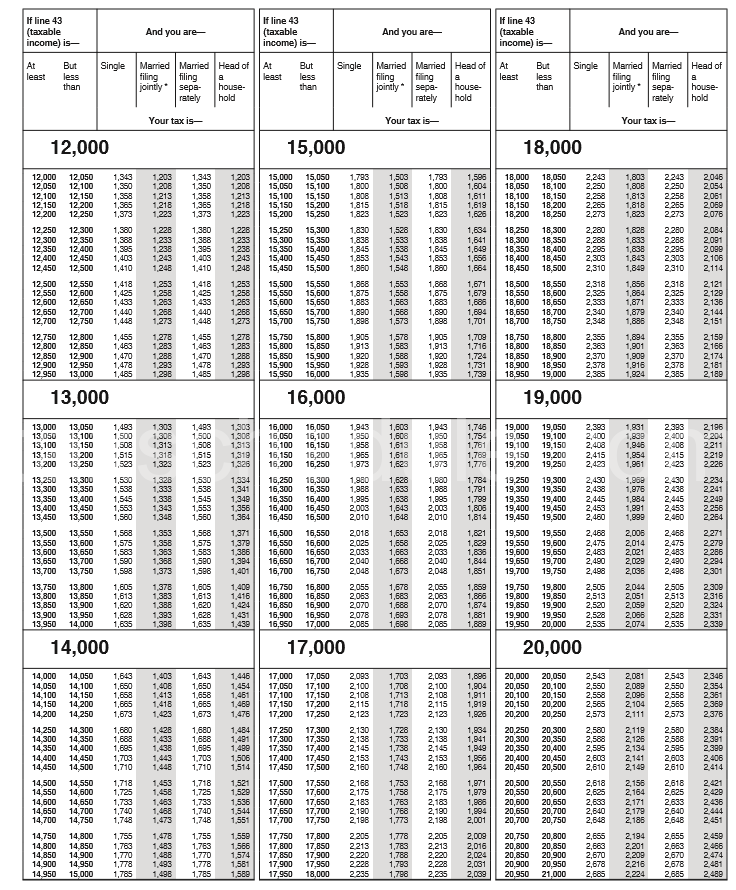

The 2025 tax tables are structured similarly to the tables used in previous years. They are organized by filing status and taxable income, and they provide the amount of tax that taxpayers owe. The filing statuses are:

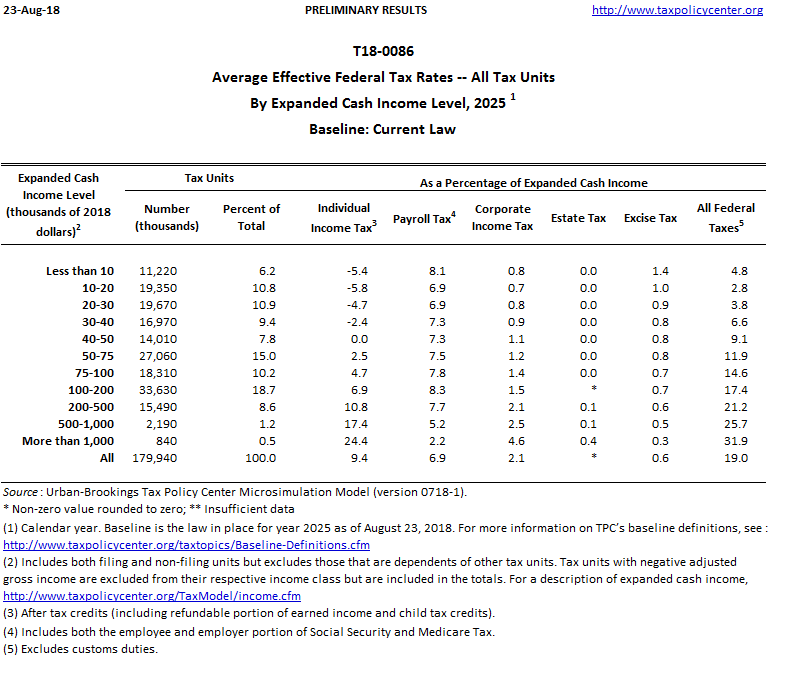

The taxable income ranges are divided into brackets, and the tax rate increases as the taxable income increases. The tax rates for the 2025 tax year are as follows:

Suppose that you are single and your taxable income is $50,000. To calculate your federal income tax, you would use the tax table for single filers. You would find the row for taxable income between $41,775 and $89,075. The amount of tax that you owe is $9,967.50.

The 2025 IRS tax tables are an important tool for calculating federal income taxes. The tables have been updated to reflect the changes made by the TCJA of 2017, and they provide taxpayers with the information they need to determine how much tax they owe. Taxpayers should consult the 2025 tax tables when preparing their 2025 tax returns.

Thus, we hope this article has provided valuable insights into 2025 IRS Tax Tables: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!